Stay Ahead of the Game: Discover Stocks with Strong Relative Strength as NIFTY Remains Uncertain in the Week Ahead

This week, Nifty is expected to remain tentative as market participants closely monitor various factors influencing the stock market. Investors are advised to look for stocks exhibiting strong relative strength to potentially outperform in the current market environment.

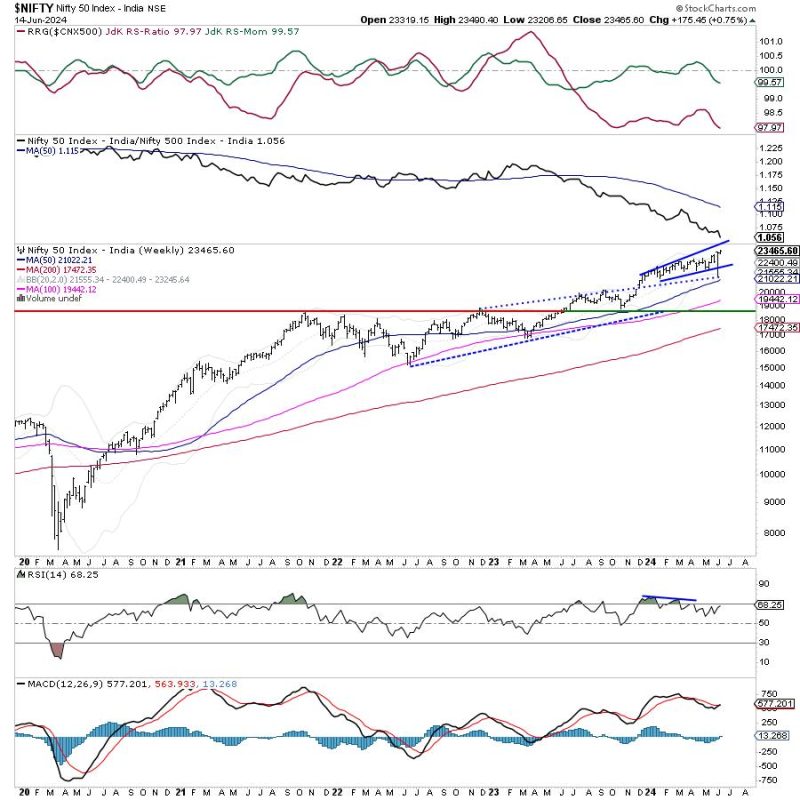

One key factor to watch this week is the performance of major indices and their behavior in response to ongoing market trends and external factors. Nifty may experience fluctuations as it reacts to changing market conditions, global cues, and domestic economic data releases.

Additionally, investors should pay close attention to individual stock movements and identify stocks with strong relative strength indicators. Companies with solid fundamentals, positive earnings growth prospects, and resilient stock price performance may offer better opportunities for long-term investing.

Sector-wise, sectors such as IT, Pharma, and FMCG could attract investor interest due to their defensive characteristics and the potential for steady growth. Conversely, sectors like banking and real estate may face challenges amid changing economic conditions and regulatory developments.

Technical analysis tools can be valuable in identifying stocks with strong relative strength. Metrics such as price momentum, moving averages, and volume trends can provide insights into stock performance and potential price movements.

Risk management is paramount in navigating the current market environment. Diversification, setting stop-loss orders, and regularly reviewing investment portfolios are essential practices for investors to safeguard their capital and optimize returns.

In conclusion, the coming week is likely to be characterized by cautious market sentiment, with Nifty staying tentative amidst evolving market dynamics. Investors can enhance their investment strategy by focusing on stocks with strong relative strength, conducting thorough research, and staying informed about market developments. By adopting a disciplined approach and adhering to risk management principles, investors can position themselves to capitalize on market opportunities and achieve long-term investment success.