In the world of finance and investing, the topic of interest rates and their impact on stock performance is a perennially debated one. Many investors closely watch central bank decisions regarding interest rate changes and attempt to predict how these adjustments will play out in the stock market. The latest discussions are often centered around whether a rate cut by the Federal Reserve or other central banks will lead to a bullish or bearish market sentiment.

While some market participants believe that rate cuts are inherently positive for stocks, there is a faction that argues the opposite. This debate highlights the complexity and uncertainty inherent in the relationship between interest rates and stock performance.

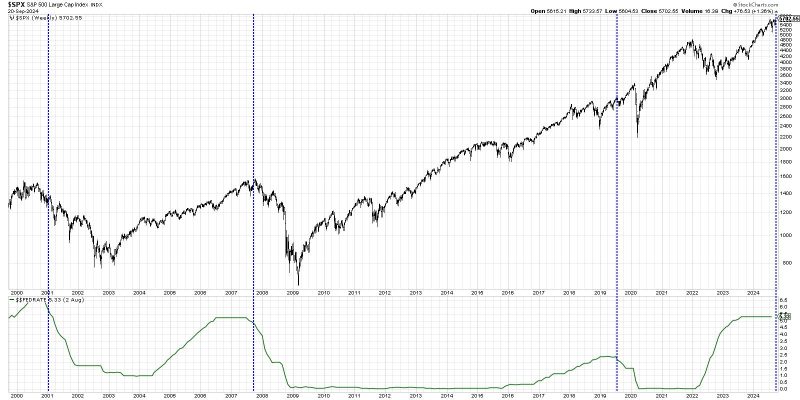

Historically, the impact of rate cuts on stock performance has varied, depending on the economic backdrop and prevailing market conditions. In some cases, rate cuts have been accompanied by robust stock market rallies, as investors anticipate improved corporate profitability and economic growth due to lower borrowing costs. As a result, stocks tend to perform well in a lower interest rate environment, with sectors such as technology, consumer discretionary, and financials often leading the way.

However, it is essential to note that the relationship between rate cuts and stock performance is not always straightforward. In certain instances, rate cuts have failed to provide the expected stimulus to equity markets, as concerns about economic instability or other macroeconomic factors overshadow the potential benefits of lower interest rates. In these cases, stocks may exhibit a muted or even negative response to rate cuts, reflecting the prevailing uncertainties and risks in the market environment.

Moreover, the effectiveness of rate cuts in boosting stock prices can be influenced by factors beyond just interest rates. Geopolitical events, trade tensions, earnings reports, and consumer sentiment are among the many variables that can impact stock market performance, sometimes overshadowing the impact of rate cuts.

For investors, navigating the complexities of interest rates and their implications for stock performance requires a nuanced understanding of the broader market dynamics. While rate cuts can provide a tailwind for stocks in certain situations, they are not a foolproof indicator of future market trends. Investors should consider a diverse range of factors and market indicators when making investment decisions, rather than relying solely on the expectation of rate cuts to drive stock prices higher. By maintaining a disciplined and well-informed approach to investing, investors can position themselves to navigate the complexities of the financial markets and achieve their long-term investment goals.