NIFTY Forecast: Ranging Week Ahead with Potential Trending Moves on the Horizon!

In the fast-paced world of stock market investing, keeping a close eye on key indicators and technical patterns can make a significant difference in making informed decisions. The upcoming week is expected to see the Nifty index maintain its range-bound trading pattern, with potential trending moves only expected if specific levels are breached.

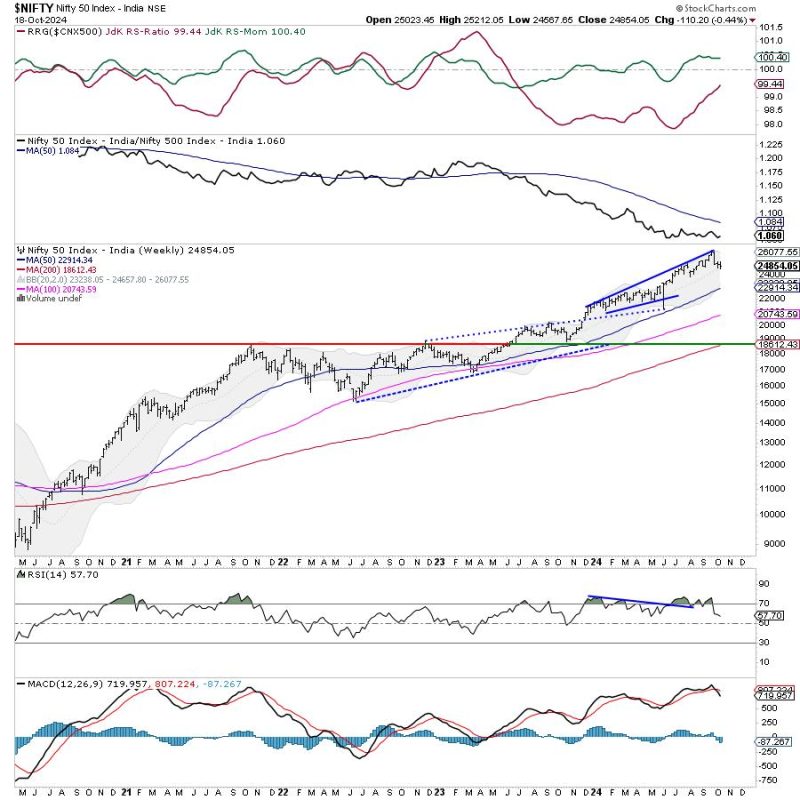

One essential aspect to monitor is the Nifty’s performance relative to key support and resistance levels. As highlighted in the article, breaching these levels can trigger further market movements. Traders and investors are advised to pay close attention to these levels to assess the market sentiment and potential direction.

Another crucial factor to consider is the overall market trend and momentum. Identifying whether the market is favoring bulls or bears can provide valuable insights into potential price movements. Technical indicators such as moving averages, RSI, or MACD can act as useful tools in gauging market momentum and making informed trading decisions.

Market participants should also keep an eye on global economic and geopolitical events that could impact market sentiment. Economic data releases, central bank announcements, or geopolitical tensions can all contribute to market volatility and influence trading decisions.

Risk management is an indispensable aspect of successful trading. Setting stop-loss orders, diversifying portfolio holdings, and adhering to a well-defined trading plan can help mitigate potential losses and safeguard investment capital.

Lastly, remaining disciplined and avoiding emotional trading decisions is key to long-term success in the stock market. Emotions such as fear and greed can cloud judgment and lead to impulsive trading actions. Following a systematic approach based on research and analysis can help traders navigate market uncertainties and capitalize on opportunities.

In conclusion, staying informed about technical analysis, key support and resistance levels, market trends, global events, risk management, and emotional discipline are essential for navigating the dynamic stock market landscape. By incorporating these principles into their trading strategy, investors can improve their chances of success and achieve their financial goals.