The recent financial markets outlook has shown signs of becoming bearish in the short term, with investors taking a more cautious approach as they anticipate a week filled with crucial news events. This shift in sentiment may result in increased market volatility and potential downward pressure on various asset classes.

One of the key factors contributing to the short-term bearish signal is the upcoming release of several important economic indicators and central bank statements. These reports have the potential to significantly impact the direction of market movements, leading traders to adopt a more risk-averse stance.

Additionally, geopolitical tensions and uncertainties surrounding trade agreements have added to the cautious mood among investors. The ongoing discussions between global economic powers have raised concerns about the potential impact on international trade and financial markets, further fueling the bearish sentiment.

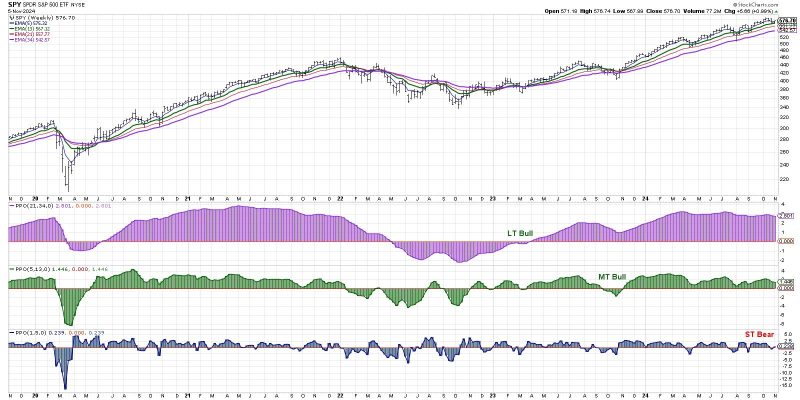

The recent performance of major stock indices has also added to the growing concerns about a downturn in the markets. Several key benchmarks have experienced a period of consolidation and even slight declines, signaling a potential shift in market sentiment towards a more pessimistic outlook.

Furthermore, technical indicators and market data point to a growing sense of unease among market participants. The increased volume of put options being traded and the rising levels of short interest suggest that investors are positioning themselves for a potential market correction or pullback in the near future.

In conclusion, the current market conditions paint a picture of growing caution and uncertainty among investors, leading to a short-term bearish signal in the financial markets. The upcoming news-heavy week, coupled with geopolitical tensions and technical indicators, has contributed to this shift in sentiment. As traders brace themselves for potential downside risks, it remains crucial to closely monitor key developments and events that could shape market movements in the days ahead.