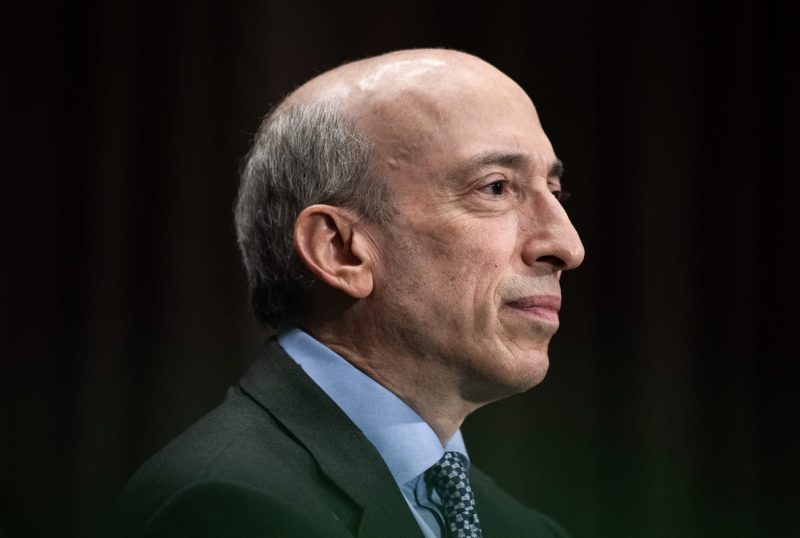

Sudden Shake-Up: SEC Chair Gary Gensler Resigns, Paving the Path for Trump’s Successor on Jan. 20

The recent announcement of Securities and Exchange Commission (SEC) Chair Gary Gensler’s resignation has sparked speculation about the future of the regulatory landscape. Gensler, known for his tough stance on Wall Street and commitment to investor protection, will step down on January 20th, paving the way for a new appointment by the incoming Trump administration.

Gensler’s tenure at the SEC has been marked by a series of high-profile enforcement actions against major financial institutions and increased scrutiny of cryptocurrency and digital asset markets. His departure comes at a critical juncture, with the SEC facing mounting challenges in regulating the rapidly evolving financial technology sector.

In response to Gensler’s impending exit, industry experts and stakeholders have expressed mixed reactions. Some view his departure as an opportunity for the SEC to adopt a more business-friendly approach under the new administration, while others fear a rollback of key regulations implemented during Gensler’s leadership.

One of the key areas of focus during Gensler’s tenure was enhancing transparency and accountability in the securities markets. He spearheaded efforts to improve disclosure requirements for public companies and strengthen oversight of trading practices to prevent market manipulation. Gensler’s successor will face the daunting task of upholding these principles while balancing the need for regulatory efficiency and economic growth.

The appointment of a new SEC chair by the Trump administration is expected to have far-reaching implications for the financial industry. The incoming chair will likely be tasked with striking a delicate balance between promoting innovation and safeguarding investor interests, amidst a backdrop of rapid technological advancements and evolving market dynamics.

As the SEC prepares for a leadership transition, market participants are closely watching for signals on the direction of future regulatory policy. The choice of Gensler’s successor will be closely scrutinized for clues about the administration’s priorities and agenda for the financial sector.

In conclusion, Gary Gensler’s impending departure as SEC Chair marks the end of an era characterized by robust enforcement and regulatory activism. The transition to a new leadership under the Trump administration signals a potential shift in regulatory priorities and approach. The upcoming appointment of a new SEC chair will shape the future of financial regulation and have implications for market participants, investors, and the broader economy.